OVERVIEW OF TOWERCOS: TELECOMMUNICATIONS INFRASTRUCTURE LEASING COMPANIES

In the upcoming “new era”, telecommunications technology has become a top priority for the government to achieve double-digit growth over the next five years. On January 11, 2024, the Prime Minister approved Vietnam’s 2021-2030 telecommunications infrastructure plan, with a vision extending to 2050.

A key goal is to develop broadband networks and deploy 5G, aiming for 99% population coverage by 2030. To realize this vision, the telecommunications infrastructure and the role of tower companies (Towercos) are crucial.

What are Towercos?

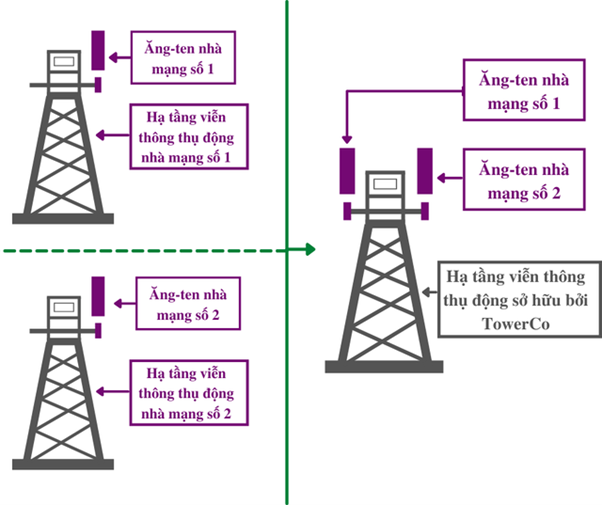

Towercos invest in and own telecommunications infrastructure, such as macro and small cell towers, which they lease to mobile network operators. They are also responsible for operating and maintaining this infrastructure. In addition to towers, Towercos invest in and lease other telecom assets and related infrastructure, including distributed antenna systems, fiber optics, and power systems.

Inevitability of Infrastructure Sharing

In developed telecom markets, operators increasingly lease infrastructure from Towercos and share it with others, reducing fixed asset investment burdens and allowing them to focus resources on enhancing service quality for customers. Many global operators have decreased their ownership stakes and separated their passive infrastructure to form dedicated Towercos or joint ventures. A notable example is China Tower, established in 2016 by the country’s three largest mobile network operators.

In contrast, Vietnam’s nascent market still sees operators viewing ownership of telecom infrastructure as a competitive advantage. However, as the density of base stations increases, it leads to waste, infrastructure duplication, and urban aesthetic issues. The Vietnamese government has also called for telecom infrastructure sharing, as outlined in Directive No. 52/CT-BTTTT on November 11, 2019.

Business Model and Economic Efficiency of Towercos

Towercos incur initial capital expenditure (CAPEX) when building a telecom tower, with ongoing costs primarily consisting of depreciation, land rent, electricity, and maintenance (approximately 3% of annual revenue), keeping variable costs low. Multiple active network devices from different operators can be installed on a single tower. Unlike operators, which must constantly invest in active network equipment to stay technologically competitive, Towercos face minimal obsolescence risk.

Telecom tower leases typically have long, irrevocable terms of 5 to 10 years. The economic efficiency of Towercos is maximized as scale increases, demonstrated by having more tenants and additional antennas on a single tower. The incremental costs of adding these antennas are minimal, leading to significantly higher profit margins as the tenancy rate increases.

Vietnam: A Promising Market

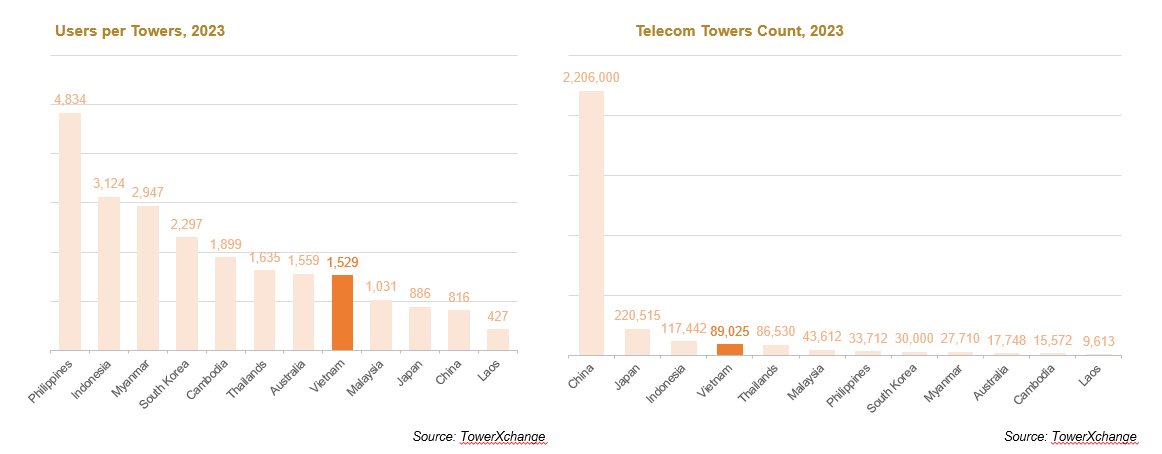

Vietnam is seen as a high-potential market for Towercos, with both sharing ratios and tower rental prices significantly below regional and global averages. Currently, the sharing ratio in Vietnam ranges from 1.2 to 1.3, compared to 2.5 in the U.S., 1.48 in China, 2.1 in India, 1.6 in Myanmar, and 1.8 in Indonesia.Tower rental fees in Vietnam are around $300 per tower per month, considerably lower than in ASEAN countries like Myanmar ($900), Indonesia ($1,150), and Malaysia ($1,250).

The rollout of 5G is expected to bring substantial economic benefits, including enhanced growth, increased efficiency, and the creation of new industries. According to Qualcomm, 5G could generate $13.1 trillion in economic value and create 22.3 million new jobs globally by 2035. While 5G technology offers high-speed, stable transmission with low latency, it requires denser base station deployment due to narrower coverage.

Vietnam ranks among the top in Southeast Asia for infrastructure development but still falls short of developed nations, with a ratio of less than 1,000 people per tower. To effectively implement 5G and enhance 4G network performance, Vietnam must double or even triple its current number of towers, leading to substantial demand for both macro and small cell towers.

The tower leasing market in Vietnam is still in its early stages, with a penetration rate of just 9%, significantly lower than that of other countries in the region, according to TowerXchange. Currently, 89% of the towers are owned by the four main mobile network operators (MNOs)—Viettel, VNPT, MobiFone, and Vietnamobile. Viettel Construction Corporation (CTR) has established itself as the leading TowerCo in Vietnam, with 6,436 BTS towers available for lease as of the end of 2023, significantly ahead of its closest competitor, OCK Vietnam Tower (an independent TowerCo from Malaysia), which owns approximately 3,650 towers. Golden Tower accounted for 325 BTS towers, while other companies collectively owned around 5,000 towers. By the end of 2024, CTR had expanded its number of towers to 10,000 BTS, an increase of 3,564 towers, accounting for 50% of Vietnam’s total BTS towers.

Nguyen Minh Tri – Investment Department – PHFM