VIETNAM’S INSURANCE MARKET: PROMISING LONG-TERM OUTLOOK

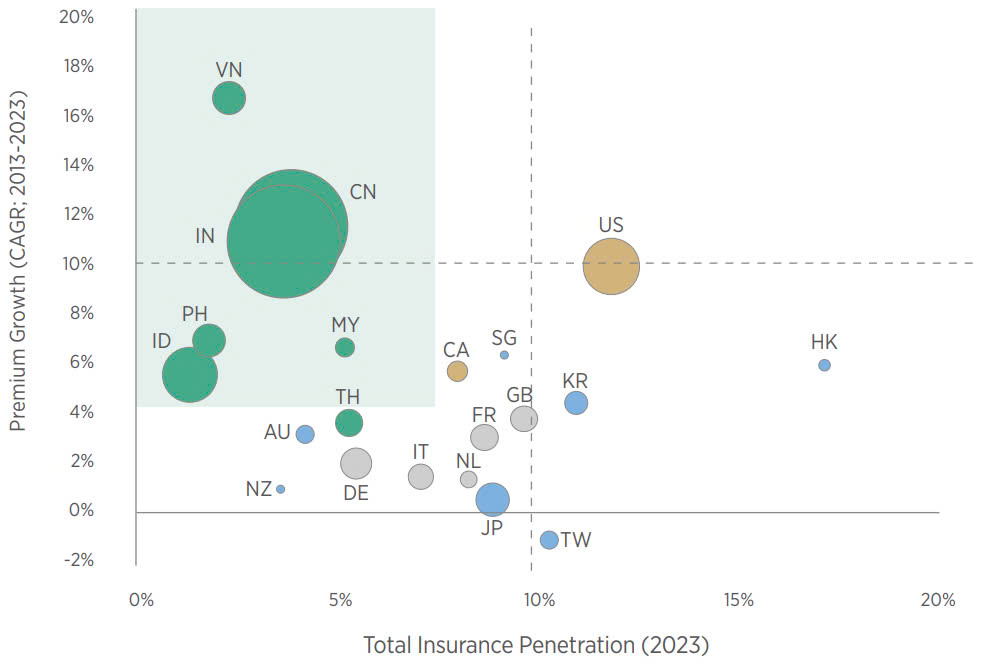

Vietnam’s insurance market still holds significant growth potential, as the insurance penetration rate (insurance premium revenue as a percentage of GDP) and per capita insurance spending remain low.

In 2023, Vietnam’s insurance penetration rate stood at 2.31% (vs the target of 3.5% for 2025), 1% lower than the average penetration rate in emerging markets and significantly below the 10% level seen in developed markets. Vietnam’s average per capita insurance premium is significantly low, equivalent to 1/3 of the level of the Asia emerging markets. Additionally, the Ministry of Finance aims to increase the proportion of the population participating in life insurance from around 12% in 2023 to 15% by 2025 and 18% by 2030. This presents a promising opportunity for companies operating in the industry. Alongside Vietnam’s economic growth prospects, the insurance sector still has significant promise.

Vietnam has a relatively low insurance penetration but the highest growth rate

Nguồn: WB, Swiss Re, PHFM

Vietnam’s bright economic outlook, stable macroeconomic conditions, and large, growing population of approximately 100 million people with a demographic dividend provide a strong foundation for the expansion of the insurance sector. The country has maintained steady economic growth, averaging about 7.0% last decade. The government has set ambitious targets to raise GDP growth to two digits and GPD per capita to $7,500 by 2030. These factors create a highly favorable environment for the insurance industry’s future development. According to estimates from the World Bank, the proportion of Vietnam’s population classified as middle class is expected to rise from 19% in 2023 to 26% by 2026. Additionally, the insurance sector is benefiting from ongoing reforms in the healthcare system, social security policies, and the increasing accessibility of insurance products through bancassurance channels.

Source: IAV, PHFM

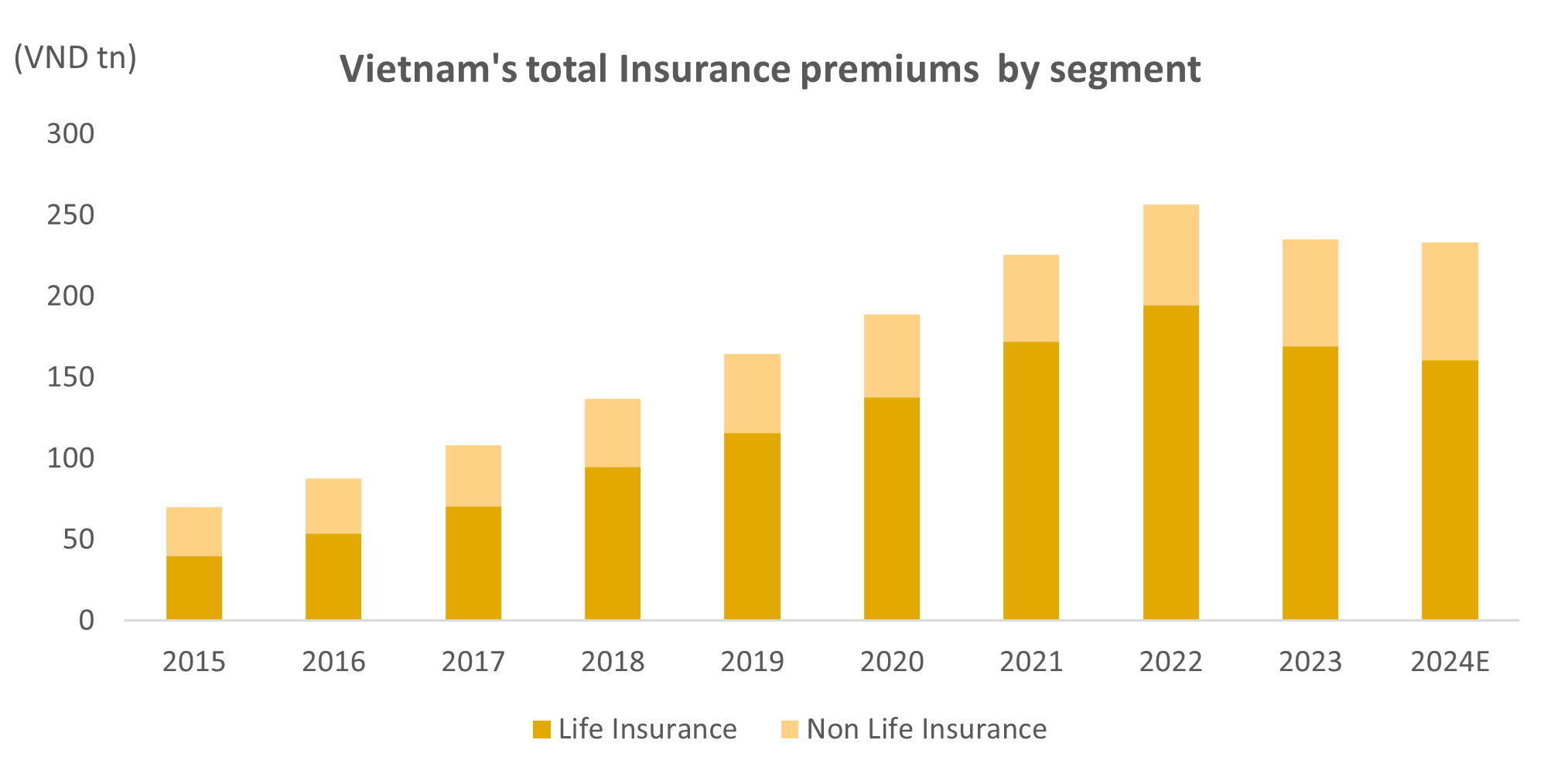

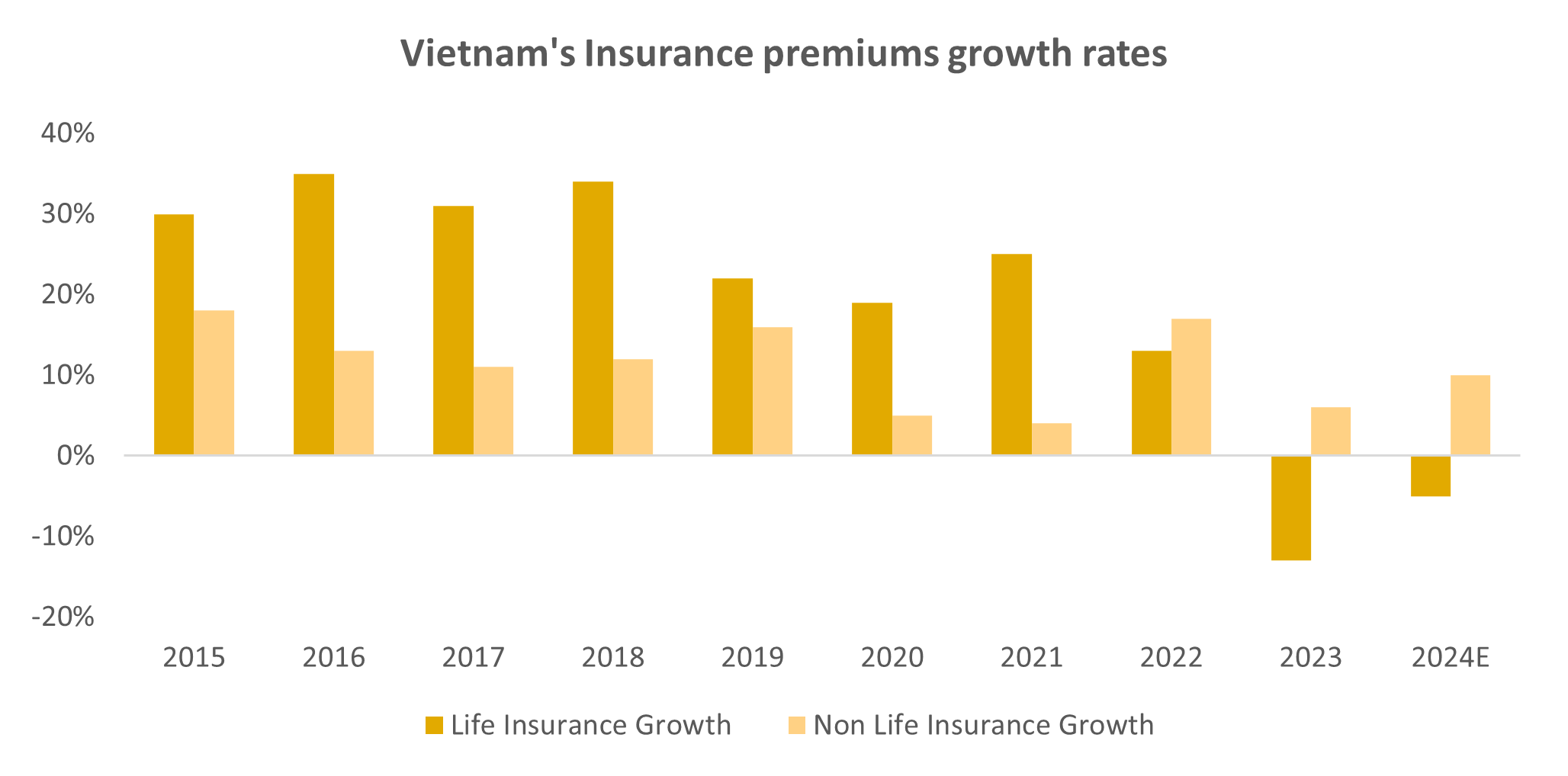

Vietnam’s insurance market demonstrated impressive growth, with total insurance premium revenue increasing by over 16% annually in the last decade. During this period, life insurance premiums grew at a rate of nearly 20% per year, while non-life insurance premiums expanded by 11% annually. However, we saw some challenges in 2022-24, the insurance industry recorded negative growth for the first time in 2023 over a decade due to the collapsed life insurance segment. The sector’s challenges were primarily driven by the crash of bancassurance and the recession of the economy, which faced a dual impact: a 44% decline in new business premiums and a 13% decrease in life insurance premiums.

Source: IAV, PHFM

In 2024, the challenge continues; the total insurance premium revenue for the market was estimated at VND 227 trillion (-0.25% yoy). Of which, life insurance premium revenue reached about VND149 trillion (-5% yoy), while revenue from non-life insurance recovered strongly by 10.2%, reaching VND78 trillion. The total new business life insurance premium revenue in 2024 was estimated to decrease by around 10% yoy, lower than the sharp decline in 2023, in which investment-linked insurance accounted for the largest share at 70%, followed by term endowment life insurance at nearly 17%.

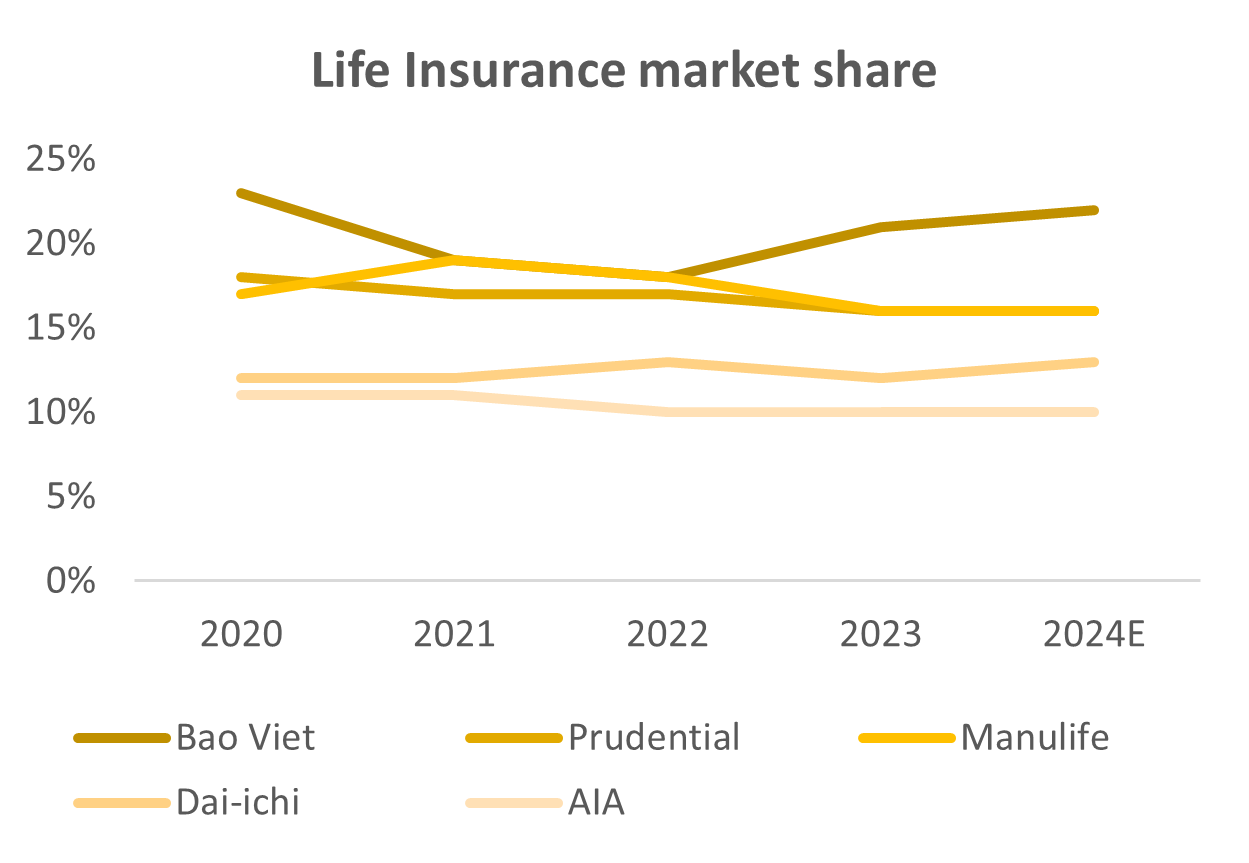

In terms of market share, the life insurance segment was dominated by foreign companies in the past, however, BVH-Life, the local player is to see an increase in market share in FY23 – 24, BVH has shown the strongest resilience during the crisis, largely due to its independence from the bancassurance channel, securing its position as the market leader in both new business premiums and total premiums written. With new regulations restricting the sale of life insurance products through banks, the competitiveness of the bancassurance channel is expected to decline significantly, as banks will no longer be able to pressure customers into purchasing unwanted policies. Following BVH, the top foreign insurers by premium revenue were Prudential, Manulife, Dai-ichi Life, and AIA.

Source: IAV, PHFM

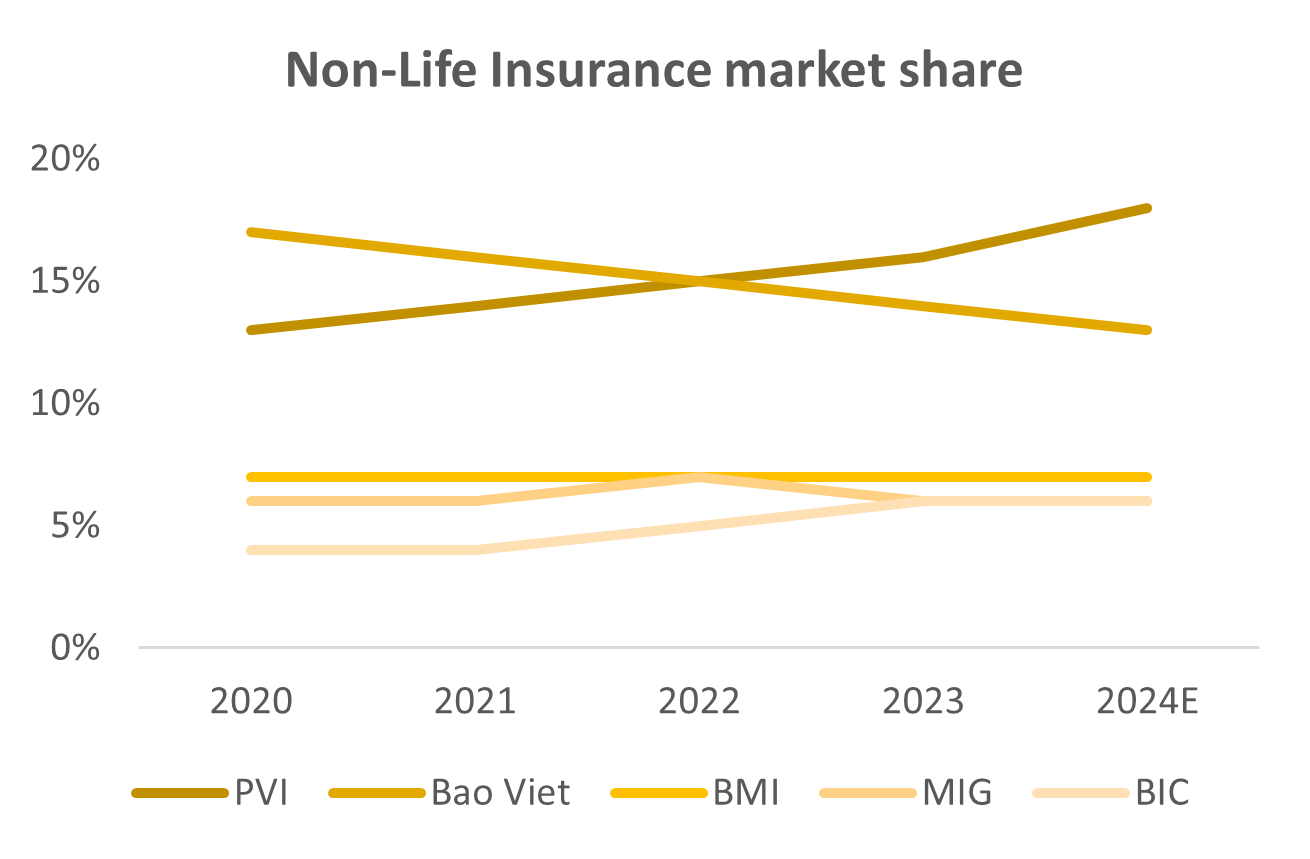

Meanwhile, Non-life premiums are estimated to grow by over 10% yoy in 2024, marking a strong rebound from the 5.1% growth recorded in FY23. This impressive expansion is driven by both the economic recovery and a low base effect. Personal accident and health insurance remain the leading product lines, surging over 20 % yoy. While commercial insurance products maintain a stable annual growth of around 10%, motor insurance continues to lag, posting only 5% growth in 2024. In terms of landscape, the two top local players are competing fiercely. PVI made significant market share gains of about 3% in FY24, with expansion across most product segments, particularly in commercial insurance, where it holds strong competitive advantages. Meanwhile, BVH’s non-life saw a notable decline in market share in 2024 despite being the leader in health insurance.

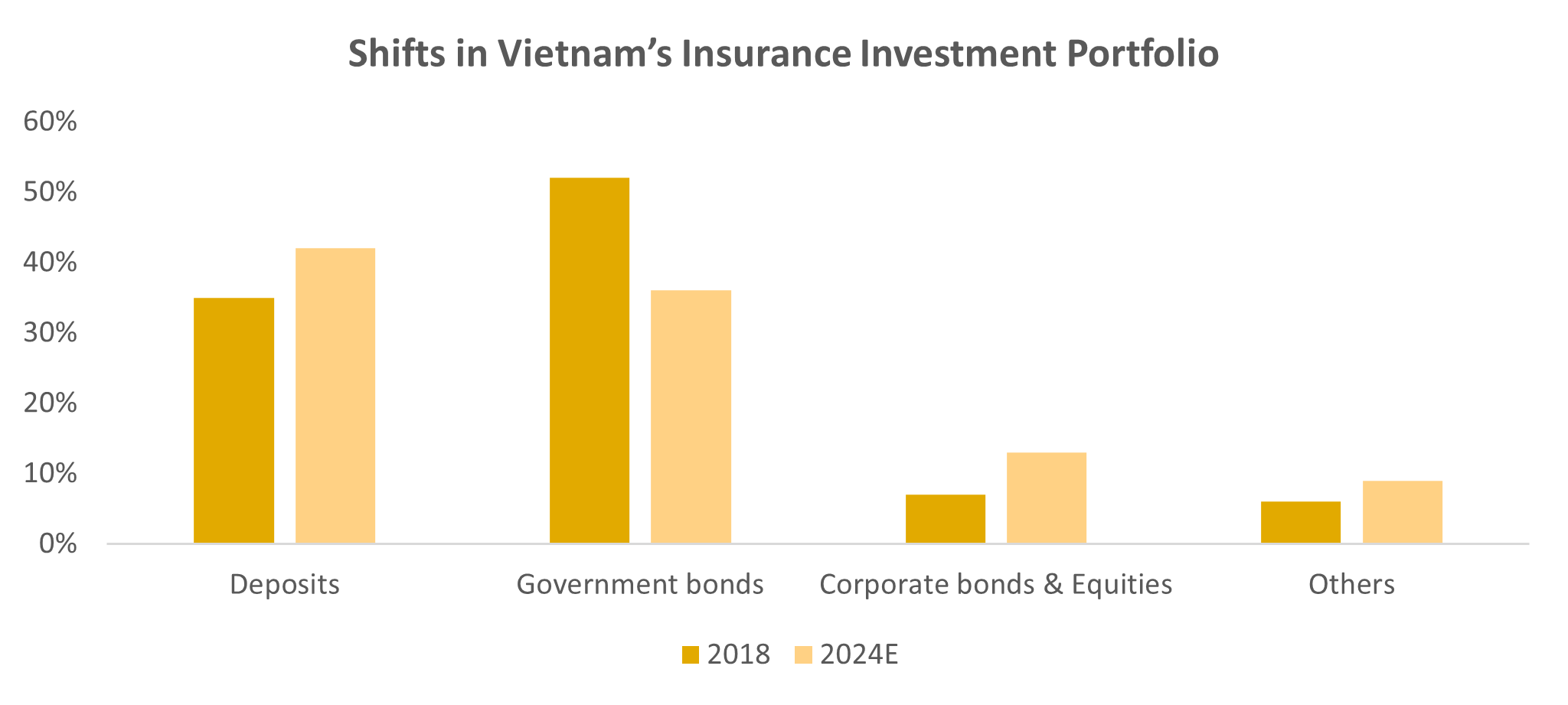

Shifts in Vietnam’s Insurance Investment Portfolio. The total assets of insurance companies grew at a compound annual growth rate of 20% in the last decade, reaching over VND 1,000 trillion in 2024E; the industry’s total investment portfolio grew at the same pace and accounted for over 83% of total assets. Notably, investments in government bonds and bank deposits accounted for over 80% of the total portfolio of insurance companies. Consequently, the recent decline in interest rates to historically low levels during the Covid pandemic has significantly impacted their financial income. Thus, insurance companies have redirected capital toward higher-yielding assets to balance investment risks, with the largest shift toward term deposits at financial institutions.

Source: IAV, PHFM

The investment portfolio of Vietnam’s insurance sector has undergone significant structural changes, especially in life insurance companies: (1) reduction in government bond holdings, the proportion of investments in government bonds dropped from 52% in 2018 to 36% by the end of 2024E, (2) increased allocation to bank deposits, the allocation to bank deposits increased from 35% in 2018 to 42% in 2024E, making it the largest asset class in the sector’s investment portfolio, (3) growing investments in corporate bonds & equities, the combined proportion of corporate bonds and stocks grew from 7% in 2018 to 13% in 2024E.

We remain quite optimistic and expect the industry to regain strong growth momentum soon driven by recovering purchasing power and the market’s early-stage development although the past three years have been an extremely challenging period for the insurance industry. Among the segments, non-life insurance is recovering faster, we expect non-life premiums to grow by two digits in the next 3 years. While life insurance will require a bit more time due to the bancassurance channel, the revenue of this segment could recover at a two-digit growth rate from 2026 onwards. Nevertheless, this also presents an opportunity for local players like BVH to gain market share or for new players to enter this high-potential market. For example, Techcombank agreed to compensate Manulife to terminate their partnership and develop its own insurance business under the TCB brand.

We believe insurance stocks are potential choices for your investment portfolio due to a promising long-term outlook, improvements in ROE, and quite attractive valuations. Additionally, we see solid EPS growth projections with the tailwind of rising interest rates in FY25 for the short-term view. We prefer companies with sustainable competitive advantages. For example, both BVH and PVI have been gaining market shares

.

Phung Minh Hoang – Investment Department – PHFM