JEWELRY – Investment vs. Ornament?

On April 11, 2025, the world gold price soared, leading the domestic gold price to break the record mark – reaching 105 million VND/ton. In the context of geopolitical instability and fears of a global economic recession, the demand for investment in gold of Vietnamese people has increased, leading to the heat of the jewelry market.

Jewelry in the investment culture of Vietnamese people

Gold has long played an important role in Vietnamese culture – not only as a beauty item, but also as an accumulated asset, a wedding gift item or considered a savings passed down from generation to generation. After periods of inflation and financial crises that caused the currency to depreciate, Vietnamese people increasingly see gold as a safe store of value, especially in the context of the current escalation of gold prices.

In developed countries such as the US, Europe, China or Hong Kong, jewelry is considered a fashion accessory, expressing personality and social status. Consumers prefer jewelry with design, sophistication, and brand value – rather than focusing on the gold content of the craft. The materials used to produce jewelry are also relatively more diverse such as platinum, white gold, and alloys. This makes a difference compared to consumer behavior in Vietnam when here, people will prefer jewelry with high gold content and purity, such as 24K gold. Jewelry products with low gold content are often less popular in Vietnam due to the high cost of manufacturing and can often be discounted by up to 30% of the value when resold to jewelry stores.

Trends in the development of the jewelry industry in Vietnam

- Potential market

Currently, Vietnamese people’s spending on jewelry is still modest when compared to developed markets. According to Statista, in 2025, per capita jewelry spending in Vietnam is expected to reach $11.30, with only 11% of that going to high-end products – a modest figure compared to the Asian average of $54.76 and the high-end segment spending rate of 27%.

However, with the development of the middle class and young population in Vietnam – a group of people who prefer fashion and personalization, PHFM expects the jewelry industry to make a strong breakthrough in the near future.

- Case study: Hong Kong Jewelry Market – From OEM to OBM

Looking at the development process of a jewelry market that is quite close to Vietnam, Hong Kong , we notice some similarities and may suggest some things about the future development of the industry. Hong Kong’s jewelry industry began in the 1950s, after half a century of development, it has grown to the global market. Initially, current big names such as Chow Tai Fook or Chow Sang Sang all started from selling gold normally, the products did not have much added value in terms of design. It is not difficult to see that this point is quite similar to Vietnam, when consumers are still mainly focused on raw gold products, less interested in other aspects of jewelry.

Until the 1970s, jewelry production in the cities was still dominated by small factories with 10 to 20 workers. From processing, to the 90s, Hong Kong was in the top 3 largest jewelry exporters in the world. Manufacturers have moved from OEMs to ODMs and have emerged a number of brand names (OBMs).

Therefore, we believe that Vietnam’s jewelry market will also gradually move towards serving the customer experience and the importance of gold in jewelry is expected to decrease. This means that when the market matures, competition will increase for domestic businesses when jewelry brands design foreign countries joining Vietnam. Brands such as Pamela, Cartier, Swarovski, Pandora,… are taking steps to penetrate more and more. Improving the brand, focusing on R&D, and launching high-tech designs will be vital factors for Vietnamese jewelry brands.

Investment perspective: The future of the jewellery industry is the future of the jewellery industry.

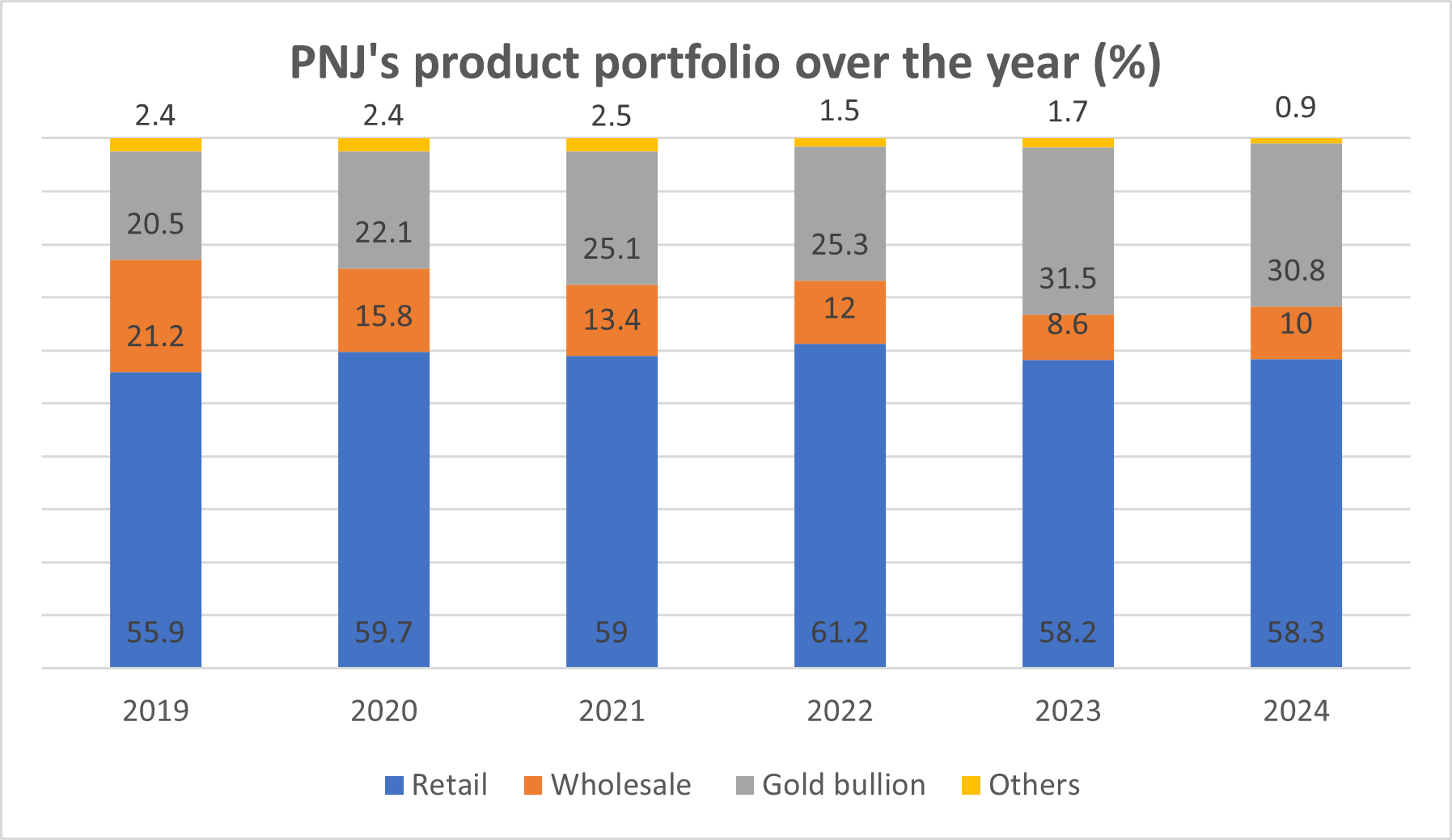

Taking PNJ as an example, designer jewelry products have a gross profit margin of up to 20-30%, compared to only 1-2% when selling ordinary gold bar products.

In recent years, when the context of high gold prices has stimulated the demand for reserves, investment, and hoarding, causing gold raw materials to become scarce, partly affecting the profit margin of businesses.

PHFM believes that with the advantage of being one of the leading enterprises in the jewelry industry with a solid experience, PNJ has an advantage in terms of gold raw materials compared to domestic small businesses as well as early awareness of future trends. In addition, PNJ is also one of the enterprises in the jewelry industry that clearly defines the company’s development orientation to become a designer jewelry retail brand in Vietnam and constantly invests in human resources, R&D and design as well as updating customer tastes.

In short, in the long term, we think the main trends in the jewelry industry will include industry mergers and competition in terms of design and R&D capabilities of enterprises instead of focusing on the gold bar business as in the past.

Nguyen Minh Tri – Investment Department – PHFM