Trump’s Tariff: Vietnam’s 46% Tariff and 90-days Suspension

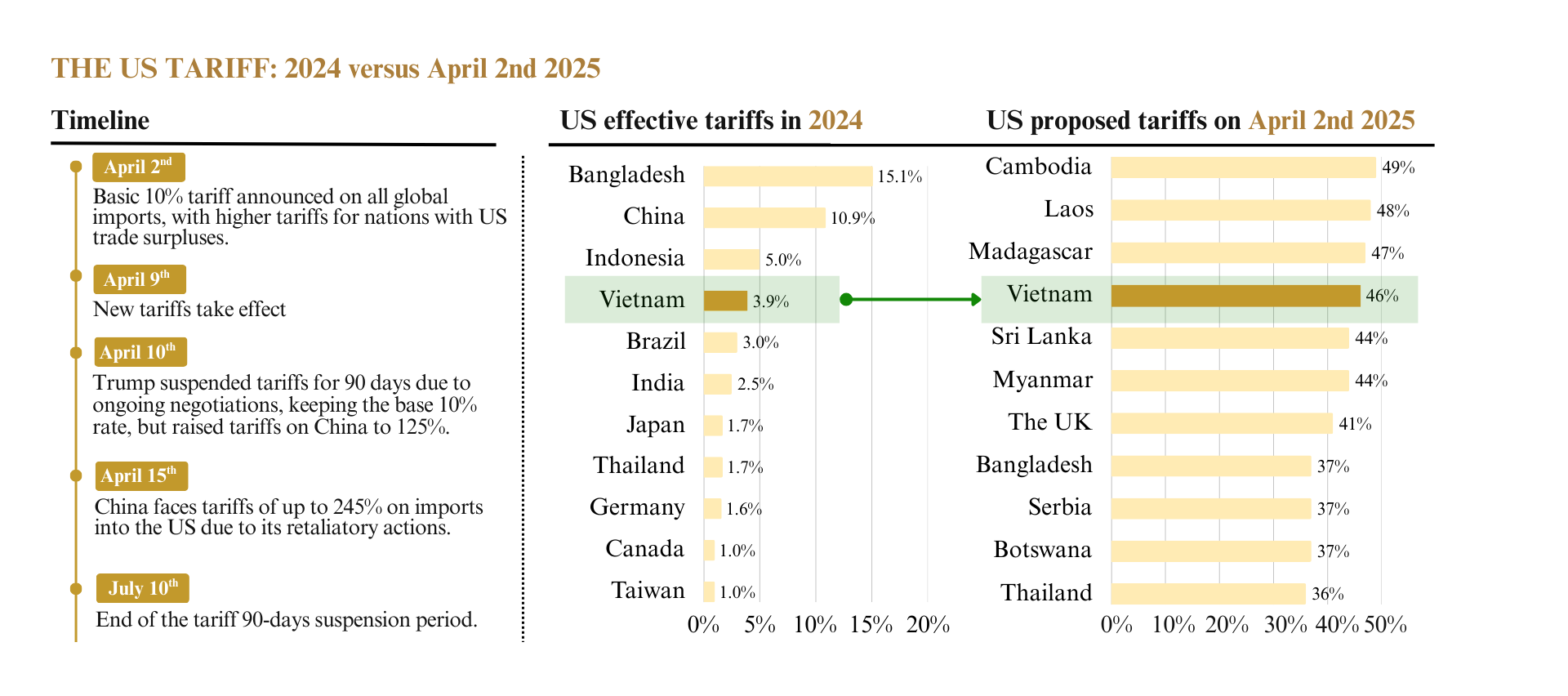

On April 2nd, President Trump announced a baseline tariff of 10% applicable to imports from all countries and territories worldwide, along with higher tariffs for countries with trade surpluses with the United States. Vietnam was among the countries facing the highest tariffs, at 46%, due to its large trade surplus with the U.S. Vietnam ranked 4th among countries with the highest reciprocal tariffs. However, just 13 hours after the new tariffs took effect on April 9th, President Trump announced a 90-day suspension and reduced the reciprocal tariff to 10%, citing that over 75 countries were actively requesting negotiations and had not yet taken retaliatory action.

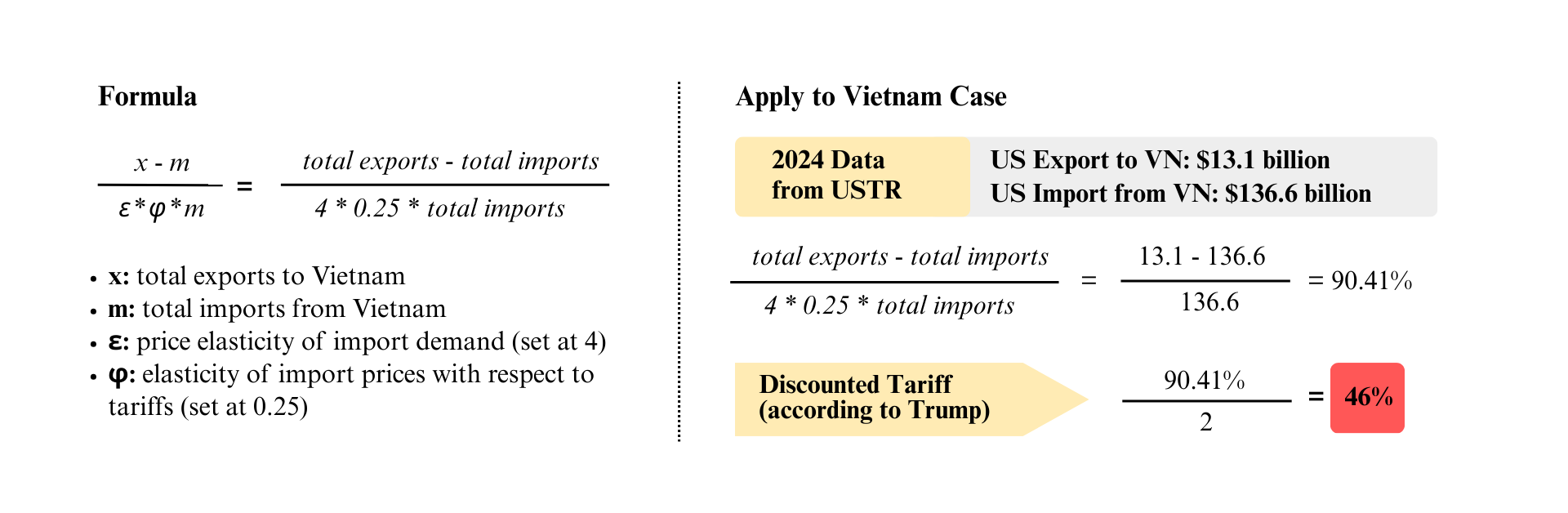

Understanding the US Reciprocal Tariff Formula

The tariff calculation is understood simply as follows: The reciprocal tariff is calculated based on the bilateral trade deficit compared to the total value of imports from that country.

Vietnam’s Trade Dependence and the Impact of US Tariffs

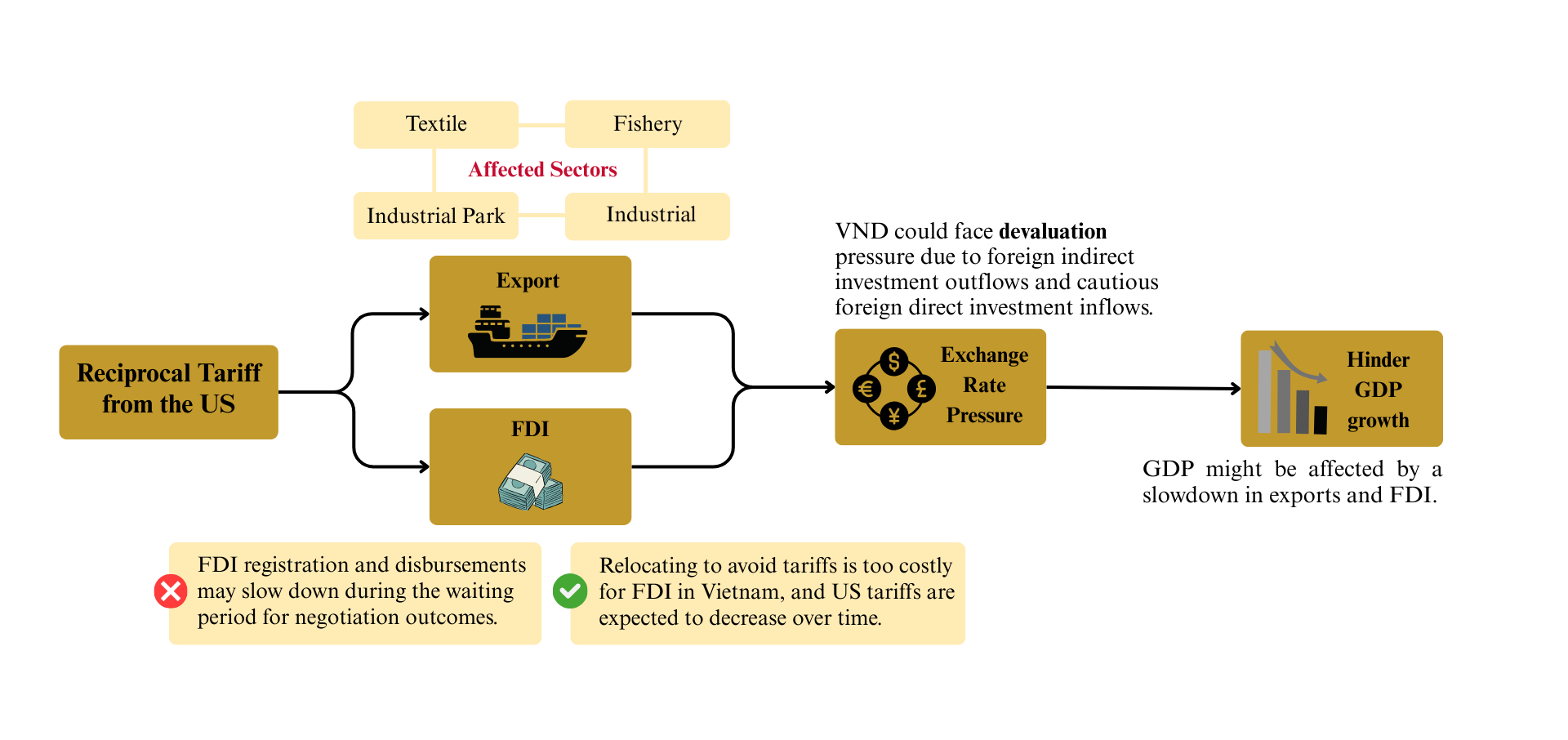

Vietnam is a nation heavily reliant on international trade, with its total import-export turnover reaching 165% of GDP. As of 2024, the United States remained Vietnam’s largest export market, accounting for 30% of its total export turnover, while China was a key import partner. Consequently, the trade war between the US and China, coupled with unpredictable tariff policies from the US, has had a severe impact on Vietnam. Four main factors affected, as discussed in this article, include: Exports, FDI, and exchange rates and GDP.

Amidst numerous uncertainties and unclear final outcomes from tariff decisions, the exchange rate is likely to experience significant short-term volatility. Concerns about tariff risks could slow down the progress of investment capital flows in both the registration and disbursement phases. Additionally, export activities, especially exports to the US market, are at risk of decline and could even suffer serious damage. At the same time, Vietnam’s current foreign exchange reserves remain at a rather limited level.

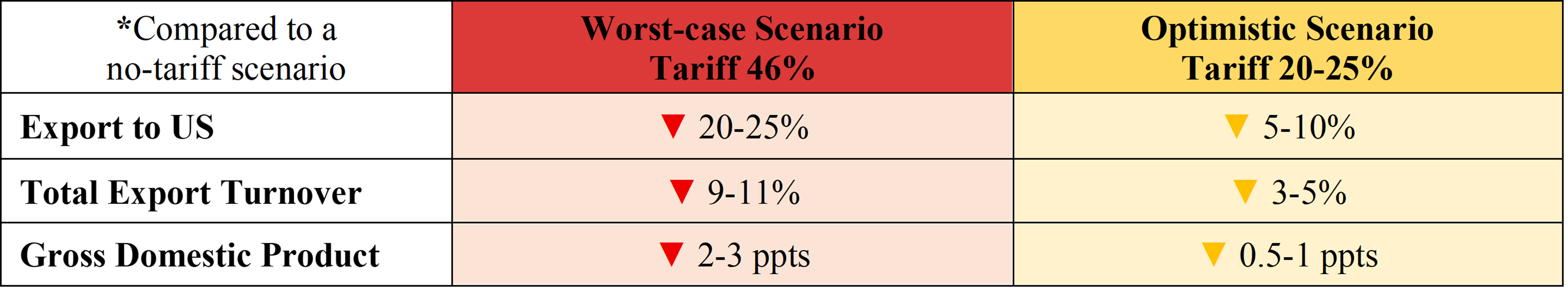

Estimates of the Impact of Reciprocal Tariffs on Vietnam’s Economy

Potential Government Response of Expansionary Fiscal and Monetary Policies

Given the pressure from taxes and the impact on investment, and exports, we predict the government will implement expansionary fiscal and monetary policies in the context of high tariffs from the US and the trade war between the US and China.

Fiscal Policy

- Boost public investment, especially in the Long Thanh Airport and North-South Railway projects (directly overseen by Prime Minister Pham Minh Chinh). This enhances the direct injection of capital into the economy, creating jobs, stimulating demand for related industries (construction, materials, etc.), and improving long-term infrastructure.

- Reduce VAT and offer tax deferred payment for affected businesses, increasing after-tax profits for businesses, potentially encouraging investment and expansion.

Monetary Policy

- Lower interest rates to encourage borrowing for business investment. This helps to lower borrowing costs for businesses and consumers, incentivizing investment, lending, and consumption. Potentially stimulates economic activity.

- The SBV might collaborate with commercial banks to introduce stimulus packages for businesses heavily affected by high US tariffs, providing direct support to vulnerable sectors, helping them mitigate potential export declines and maintain employment.

Effects on global and Vietnam financial markets

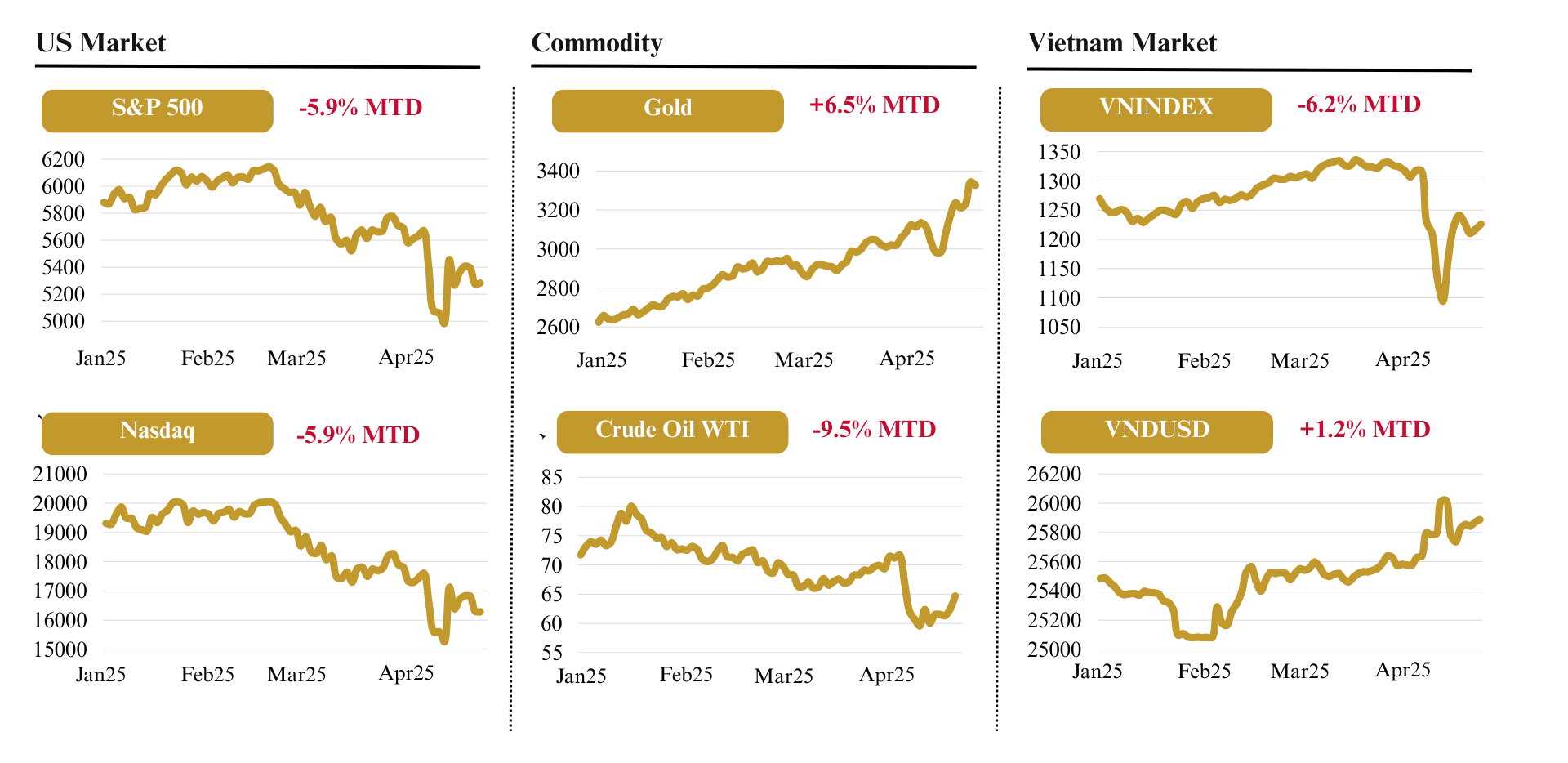

Following US President Donald Trump’s announcement of significant import tariffs on trade partners on April 2nd, the US market experienced a notable decline. As of April 17th, The Nasdaq Composite index and the S&P 500 index both dropped by 5.9% MTD. The gold price surged 6.5% MTD, while the crude oil WTI fell by 9.5% MTD. Additionally, the Vietnam stock market reacted strongly with the steepest intraday drop of 6.7% on April 3rd and plunged 6.2% MTD. There is pressure on the VND/USD exchange rate as the VND continues to depreciate against the USD.

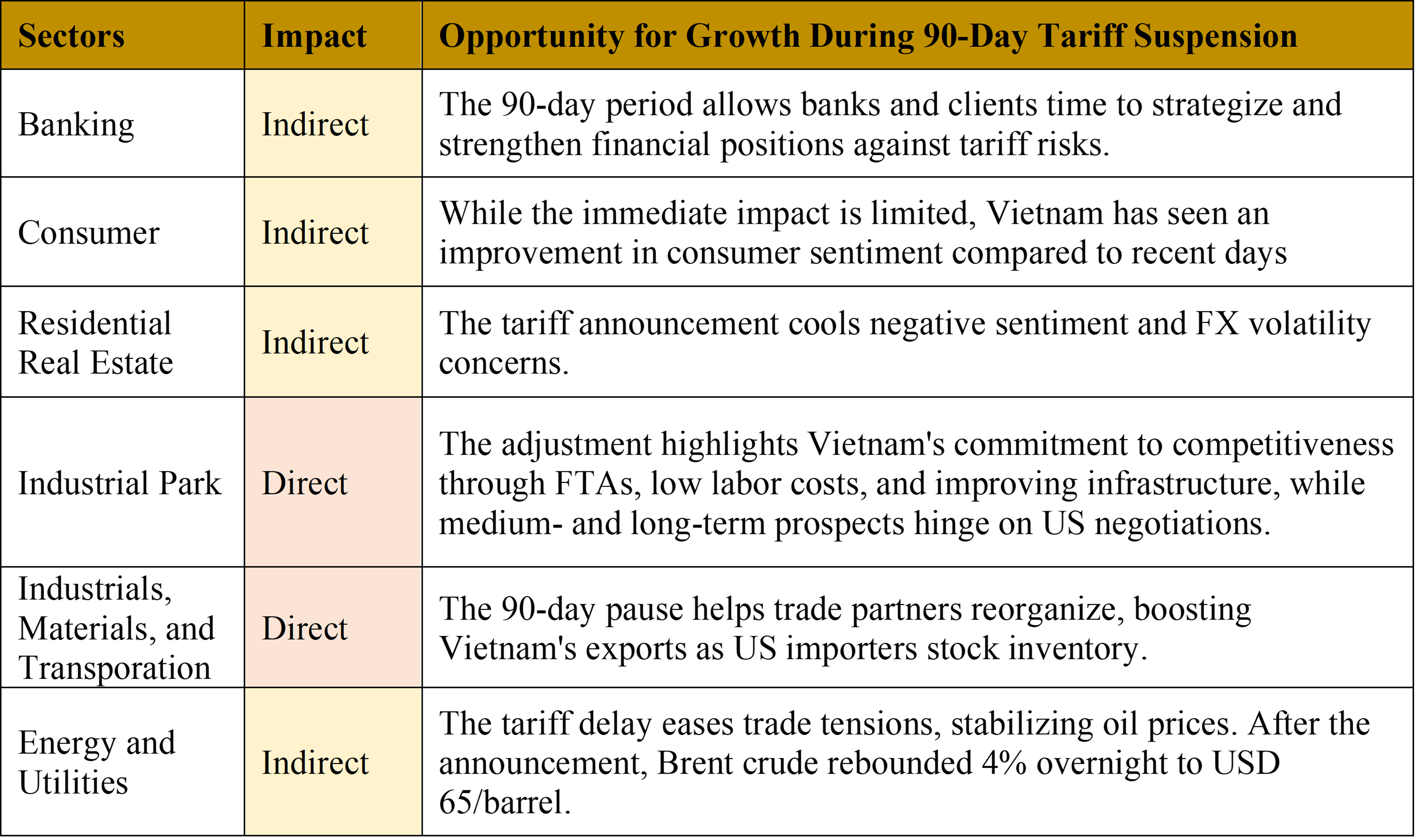

Tariff Delay – Vietnam’s Trade Diversion Advantage

Vietnam’s GDP may see a boost from trade diversion due to higher US tariffs on China. Despite a potential dip in US demand from a broad 10% tariff, Vietnam is expected to gain market share from China, with the overall effect being a net positive for Vietnam’s economy.

Conclusion

The outcome of the tariff negotiations after the 90-day period is unpredictable. Market volatility is deemed high during this vulnerable period. Investors should prioritize a diversified portfolio, focusing on defensive sectors and businesses with a mainly domestic market. Investor should also reduce exposure to sectors strongly impacted by FDI and export activities, especially those related to US exports. Notably, investors must be cautious when using leverage, as heightened market swings dramatically increase the likelihood of forced liquidations triggered by unexpected news. We do not rule out the possibility of a short-term relief rally. Investors could use these rallies to strategically rebalance their portfolios ahead of the tariff suspension ending. The unpredictability of the US President Donald Trump’s administration makes it impossible to predict what will happen when the 90-day tariff suspension ends.

Vo Viet Thanh – Investment Department – PHFM