1. Overview of the insurance sector

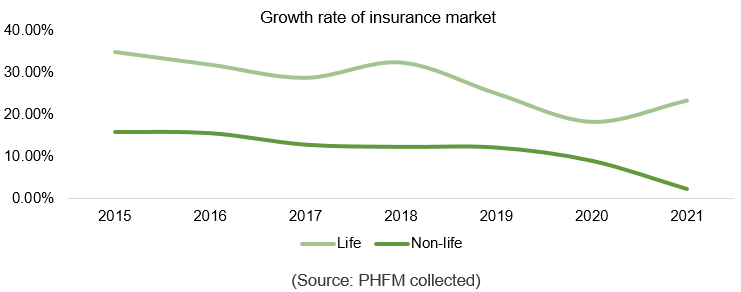

The insurance market of Vietnam witnessed a growth of nearly 20% in recent years. The impressive growth rate was contributed by a 25%-30% expansion of the life insurance market, while the non-life insurance market grew by 10% in the last few years.

In 2021, the non-life insurance market only grew by 2.3% YoY, affected by the lockdown order in 2H2021. We expect the non-life insurance market will be resilient and witness a growth of 9%-10% in 2022.

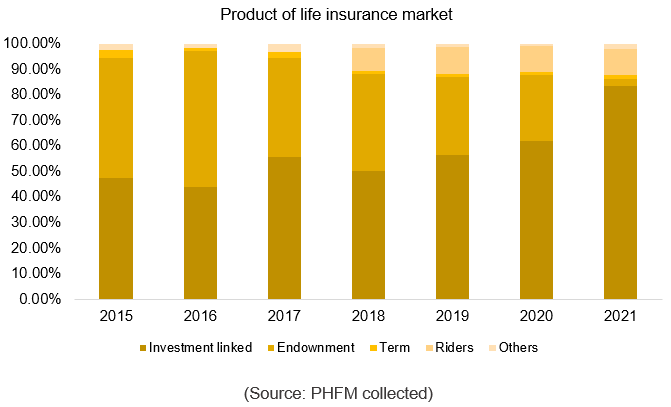

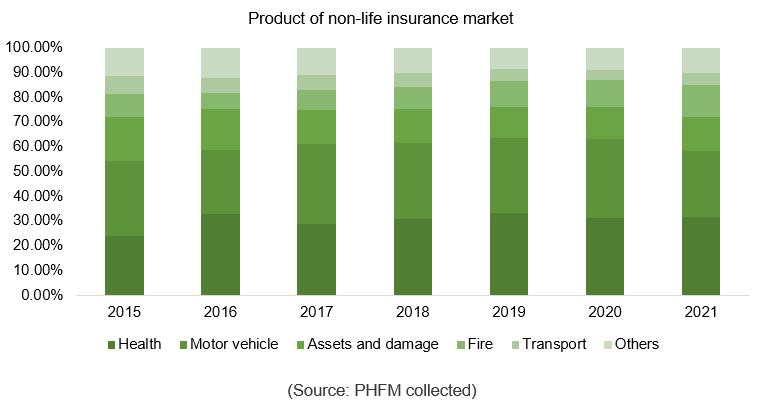

The major product lines of life and non-life are shifted toward the investment and health care needs of Vietnamese citizens:

– For the life insurance, investment-linked continued to take the highest proportion with 83.6%.

– In the non-life insurance, the healthcare and motor vehicle are the essential insurance contracts that account for 31.8% and 26.6% of the market, respectively.

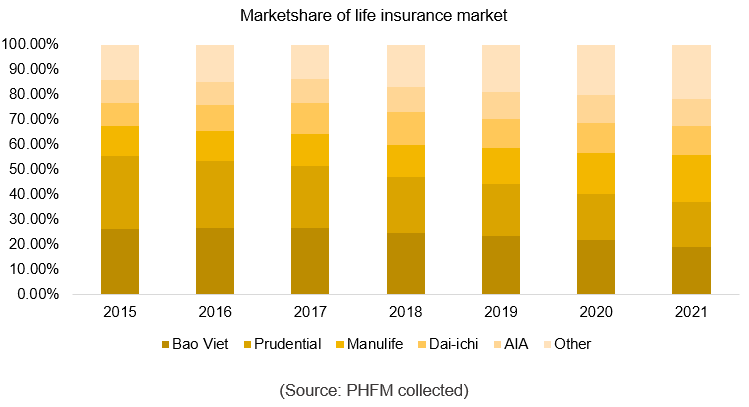

Due to the attractive growth, both the life and non-life insurance market have witnessed fierce competitiveness in recent years from the new foreign entrants. As a result, the market share of the top insurance companies has been declining in the last couple of years.

In the life insurance market, the top five insurers’ market share dropped from 86% in 2015 to 78.3% in 2021. BVH is still the leading life insurer with a market share of 19.15%. However, other foreign insurance companies have gradually taken over the market share of BVH.

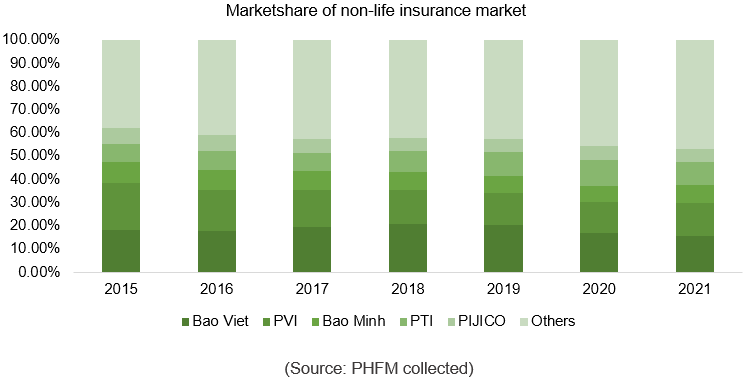

The non-life insurance market is more fragile than the life insurance market. The top five biggest insurers only accounted for 50% of the market share. However, the market share of the top insurers has been contracted and gained by other smaller ones.

2. A robust growth momentum will remain

We think that the insurance market will maintain its robust growth thanks to (1) low insurance penetration rate, (2) increasing in Vietnamese income, boosting insurance needs, and (3) improvement of the investment income from the higher interest rate environment.

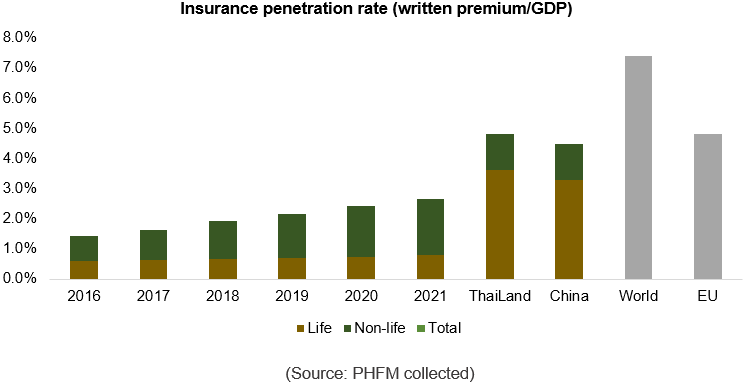

Accordingly, the insurance penetration rate of Vietnam in 2021 is only reported at 2.7%, which is much lower than the world average rate of 7.4%. The improvement of the penetration rate will boost the market size of the insurance market, thus increasing the written premium of the insurance companies.

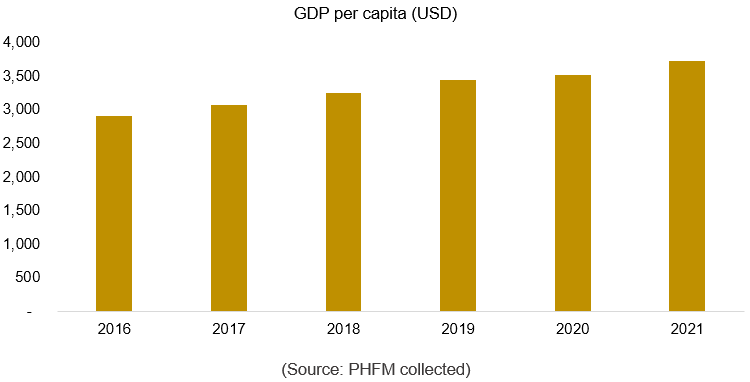

At the same time, with the solid growth of the economy and income per capita, the need and affordability for insurance should continue to rise, especially the health insurance and investment will likely boost the insurance companies’ revenue.

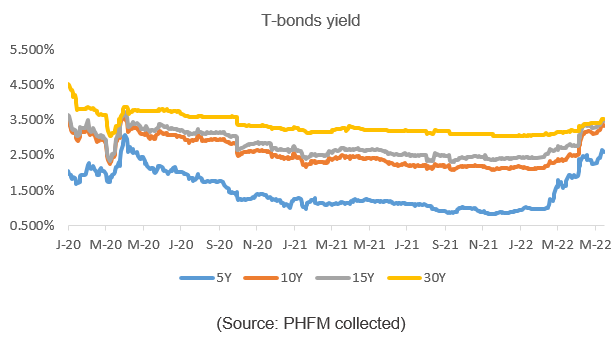

In the last two years, the insurance company has faced some difficulty due to the loose monetary policy in a low-interest-rate environment.

Most insurance companies’ investments are focused on a fixed income, including bank deposits and bonds, so the investment yield is negatively affected as the interest rate kept declining in the last couple of years.

However, the rise in interest rate from 2022 will be the main driver for the investment yield of the insurance companies to improve, thus increasing the bottom line of the insurance sector.

3. Divestment will likely re-evaluate the sector

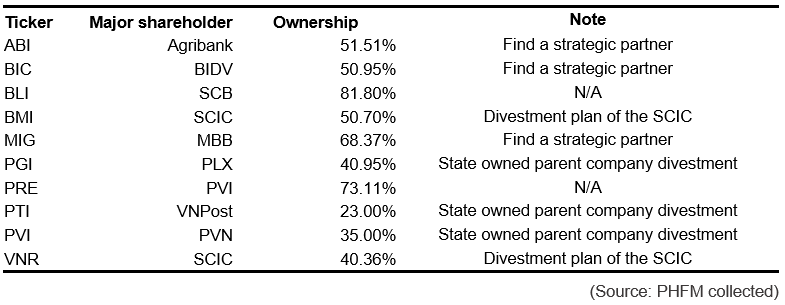

In recent years, according to the restructuring scheme of the Vietnamese government, state-owned enterprises will have to divest capital from fields that are not in their core business lines.

Meanwhile, commercial banks that own an insurance company plan to find a strategic partner and reduce the insurance company’s ownership.

In July 2021, the Vietnamese government announced that the non-life insurance would not be held over 65% by the state, thus making way for the insurer companies to find foreign partners.

The divestment of the major shareholder with controlling ownership should attract the new investors, thus re-evaluating the whole sector.

In November 2021, VNPost successfully divested all 23% of its shares with the winning auction price of VND77,000/share – equivalent to the trailing 2021 P/B and P/E of 3.36x and 25.4x, respectively.