STONE MINING INDUSTRY – POSITIVE OUTLOOK

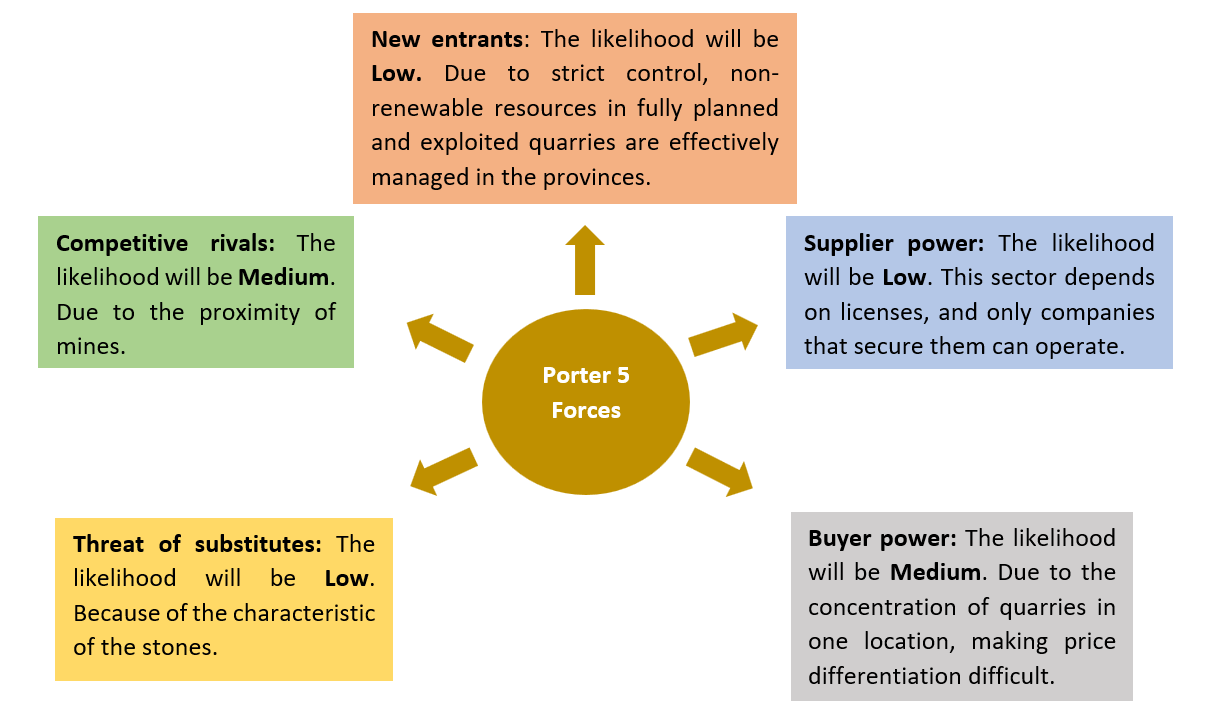

In this report, PHFM study stone mining companies in the construction materials industry. Their competitive advantage is the mining license – a valuable intangible asset that prevents new members from entering the industry. Companies in this sector have the advantage of being located near projects that have been, are being and will be implemented, and they are expected to have sustainable growth and profits in the construction materials market.

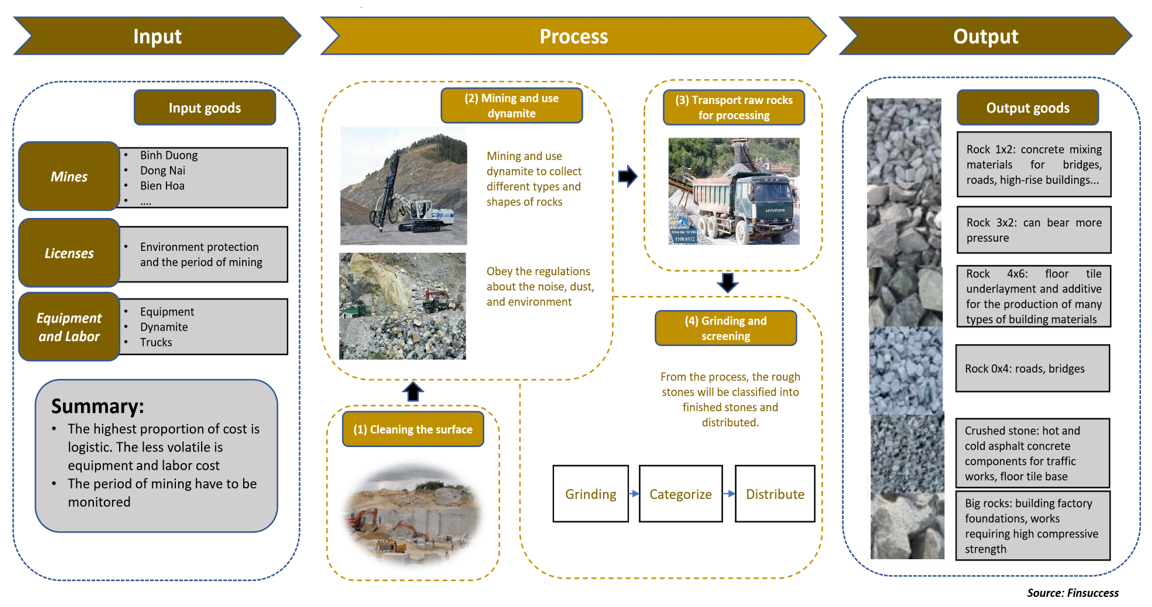

- Sector value chain

An industry with a simple value chain

The stone mining industry in Vietnam plays an important role in supplying raw materials for industries such as construction, cement and transport infrastructure.

The value chain includes the main stages: exploration, mining, processing, and distribution. The exploration and mining process requires approval from the government regarding the time and volume of mining. The processing process is quite simple, including the steps of crushing and screening the stone. The distribution process is greatly affected by the location of the quarry because high transportation costs reduce competitiveness.

- Sector overview

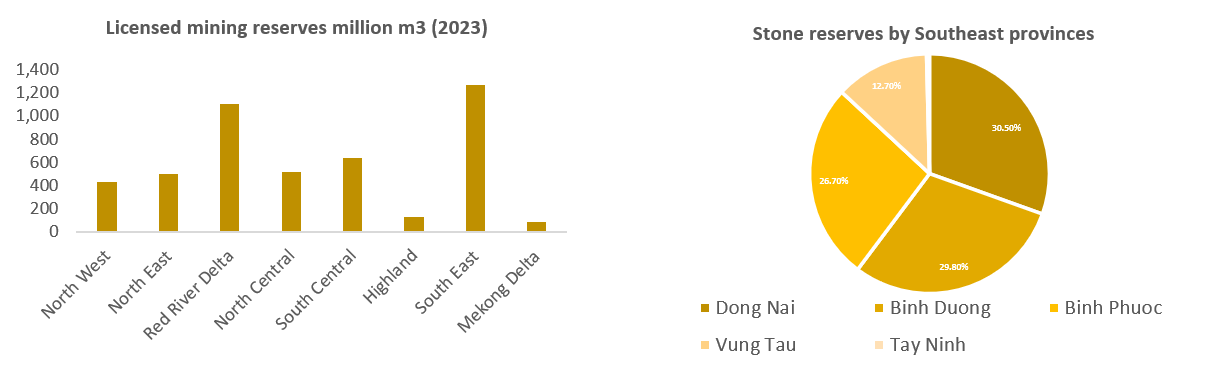

Supply is concentrated in a few provinces.

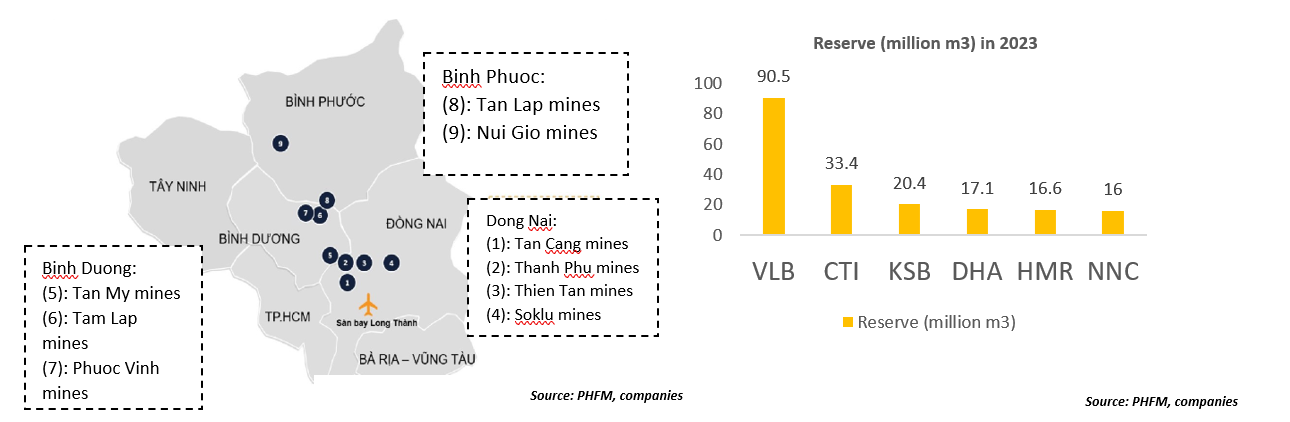

The construction stone industry is a highly specialized and concentrated sector: The Southeast region has 7 provinces engaged in stone mining: Binh Duong, Dong Nai, Binh Phuoc, Ba Ria – Vung Tau, Tay Ninh, An Giang and Kien Giang. Among these, Dong Nai and Binh Duong hold the largest reserves, accounting for over 68% of the total production volume in Southern Vietnam.

Dong Nai: The 1st of reserve in Southeast. The two areas accounted for 82% (145-200 million m3) of the province’s reserve are Vinh Cuu District, and Bien Hoa City.

Binh Duong: The 2nd of reserve in Southeast. Bac Tan Uyen, Thuong Tan, and Tan My accounted for over 60% of the reserve.

Location and license are the key drivers

Location: The location of a stone mine is crucial due to its impact on logistics costs. Mines far from transportation hubs incur higher expenses for transporting heavy materials, reducing profit margins. Proximity to key infrastructure, such as highways or railways, lowers transportation costs, improves efficiency, and ensures faster delivery, making the mine more competitive in the market.

Reserve: The reserve of a stone mine is crucial for companies as it ensures a steady supply of material, supports long-term planning, and secures contracts. A strong reserve provides financial stability, attracts investors, and helps mitigate risks, ensuring consistent operations and revenue.

Tax and other risks for mine owners

Tax: Environment tax and related exploiting tax accounted for about 23% of cost structure. Exploitation process is about 55% of cost structure and this cost is moderately fixed, other costs (selling, administration, etc) is the remaining.

The dependence on the infrastructure investment: The industry’s growth depends entirely on the development of the construction sector with 70% stone demand from public investment and 30% from the residential.

Location: Due to the characteristics of products the stone mined from quarries is primarily consumed in neighbouring provinces and cities (within a radius of 30-50 km or less), limiting the ability of businesses to expand their operational scope.

Five Forces Analysis

- Upcoming themes

Stone plays a big proportion in construction cost

Stone is used in most infrastructure projects. About 70% of the stones come from infrastructure projects, while 30% come from private projects.

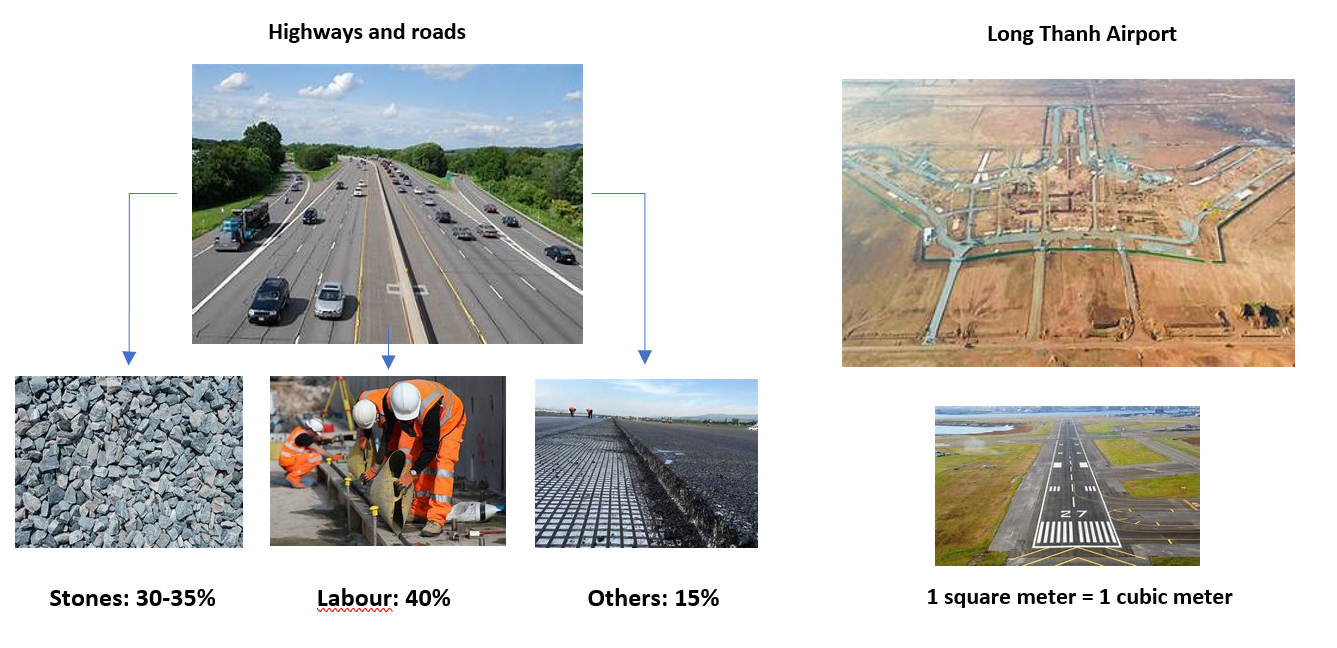

For road or highway construction, the stone usually accounts for 30-35% of the total construction cost. Long Thanh International Airport also plays an important role for stone companies in the area as 1m2 of runway requires 1m3 of construction stone.

The demand returns from public investment

Private investment is expected to recover and recent economic signals point to an expansion in manufacturing. While domestic consumption has bottomed out in 2024, there has been no significant recovery, so we expect demand to improve next year. Low lending rates and a recovery in the real estate market will also drive a new wave of private investment in 2025. Public investment is expected to accelerate in the coming period as the government places emphasis on infrastructure development, in line with the end of the current 5-year public investment cycle.

4. Conclusion

In conclusion, stone companies represent attractive investment opportunities due to their ability to generate stable cash flows and their natural monopoly characteristics, driven by the duration of licenses and the strategic location of mines. These features provide a significant competitive edge, ensuring consistent revenue generation and minimizing external competition. Furthermore, the predictability of their operations, coupled with the ease of forecasting and monitoring their performance, makes stone companies a reliable choice for investors seeking sustainable and steady portfolio growth.

Tran Minh Tri – Investment Department – PHFM