How to objectively evaluate the performance of mutual funds

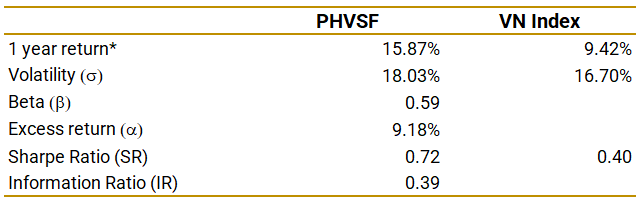

Mutual funds are still in the early stage of development in Viet Nam, but they are already a very common investment tool in other countries. Investors usually consider the rate of return when choosing mutual funds. However, there are many factors to consider in addition to the rate of return. The following is an example of PHVSF’s performance over the past 1 year* to explain the considerations for evaluating mutual funds.

- Excess Return (∝): First of all, we need to understand the investment objective of mutual funds. They are active investments. The fund managers select securities that are different from the index and allocate capital actively to achieve better returns than the index. Mutual funds are very different from ETFs. The latter aim to replicate the index because they only invest in the constituent securities of the index, disregarding the fundamentals of these securities. Therefore, the first measure of mutual fund performance is whether it can generate a better rate of return than the index, which is the excess return represented by the Greece letter ∝. PHVSF’s ∝ is 9.18%, which means that its return is 9.18 percentage points higher than the VN Index.

- Volatility (σ): Volatility is an indicator of the magnitude of the price change of an investment commodity, which is statistically called the standard deviation, which is an important concept in investment because it represents the risk that investors take in order to obtain a return on their investment. The higher the volatility, the higher the investment risk. The one-year volatility σ of PHVSF is 18%, which is higher than the VN Index’s 16.7%, which means that the price of the fund is more volatile than the benchmark. VN Index is less volatile than most stocks in the market, with 98% of stocks in our investment universe** trading higher volatility than VN Index. This is rare and is very different from other countries. There are two possible reasons for the low volatility of the index: 1) the risk is greatly diversified, as there are more than 400 stocks in the VN Index. However, this does not explain why the volatility of the VN Index is lower than that of most stocks in the market; 2) Many of the constituent stocks of VN Index are illiquid because they are sparsely traded. Since their stock prices do not move much, the volatility of these stocks is low. Mutual fund holdings require a minimum of liquidity, we do not invest illiquid stocks. We exclude illiquid stocks from our investment universe, so the volatility of PHVSF’s holdings is higher than that of the index.

- Beta value (β): β and volatility are both indicators to assess the risk of investment products. Volatility is a measure of the overall risk of investment products. β is a measure of the sensitivity of investment products to the overall market risk, that is, the sensitivity to the market factors. It is common to use main stock index as the proxy for market, so we set the VN Index’ β at 1. If β is greater than 1, it means that the relative sensitivity of the fund to the market factor is high, and less than 1 means that the relative sensitivity of the fund to the overall factor is low. PHVSF’s β is 0.59, which means that the fund is less sensitive to market factors than the index.

- Sharpe Ratio (SR): SR is a measure of risk-adjusted return, which is the excess return (excess reward/risk) per unit of additional risk. Excess returns here refer to excess returns relative to risk-free assets, and here we use Viet Nam’s 10-year government bond yield as the basis for calculation. Therefore, SR refers to how much the investor can get more than the return of the risk-free asset by taking the risk. The SR of PHVSF is 0.72 (0.72 reward per unit of risk) and the index is 0.4 (0.4 reward per unit of risk). Although investing in PHVSF takes a higher risk (volatility is higher than the index), PHVSF can also get a higher adjusted risk return.

- Information Ratio (IR): IR is the same as SR to evaluate risk-adjusted returns, but the so-called excess returns of IR are relative to index return, so whether IR is positive is an important criterion for evaluating active investment. The IR of PHVSF is 0.39, which means that the fund’s holdings deviate from the index but can generate returns that exceed the index. Investors are rewarded more than the index for the risk of active management.

We want to emphasize that the choice of mutual funds should not only be based on returns, but also on their performance relative to the index and risks. The above measures enable investors to evaluate mutual funds more objectivley.

*PHVSF was launched in November 2022 and the first half of 2023 is the portfolio building period, so we take the performance from July 2023 to June 2024.

**As of 7/16/2024, there are total 163 stocks in our investment universe, of which 160 stocks have a 360-day volatility higher than VN Index’s 16.09%.

Source: PHFM

————————————————————-

PHU HUNG FUND MANAGEMENT JOINT STOCK COMPANY (PHFM)

Office: Unit 4, 21st floor, Phu My Hung Tower, No. 8 Hoang Van Thai Street, Quarter 1, Tan Phu Ward, District 7, Ho Chi Minh City

Phone: (84-28) 5413 7991

Email: phfm@phfm.vn

Website: www.phfm.vn