WHICH INVESTMENT HORIZON IS SUITABLE FOR THE VIETNAMESE STOCK MARKET?

To address the above question, we provide some arguments comparing the index returns in the short, medium and long term based on the closing price of VNIndex for the 20-year period from July 1, 2004 to June 30, 2024.

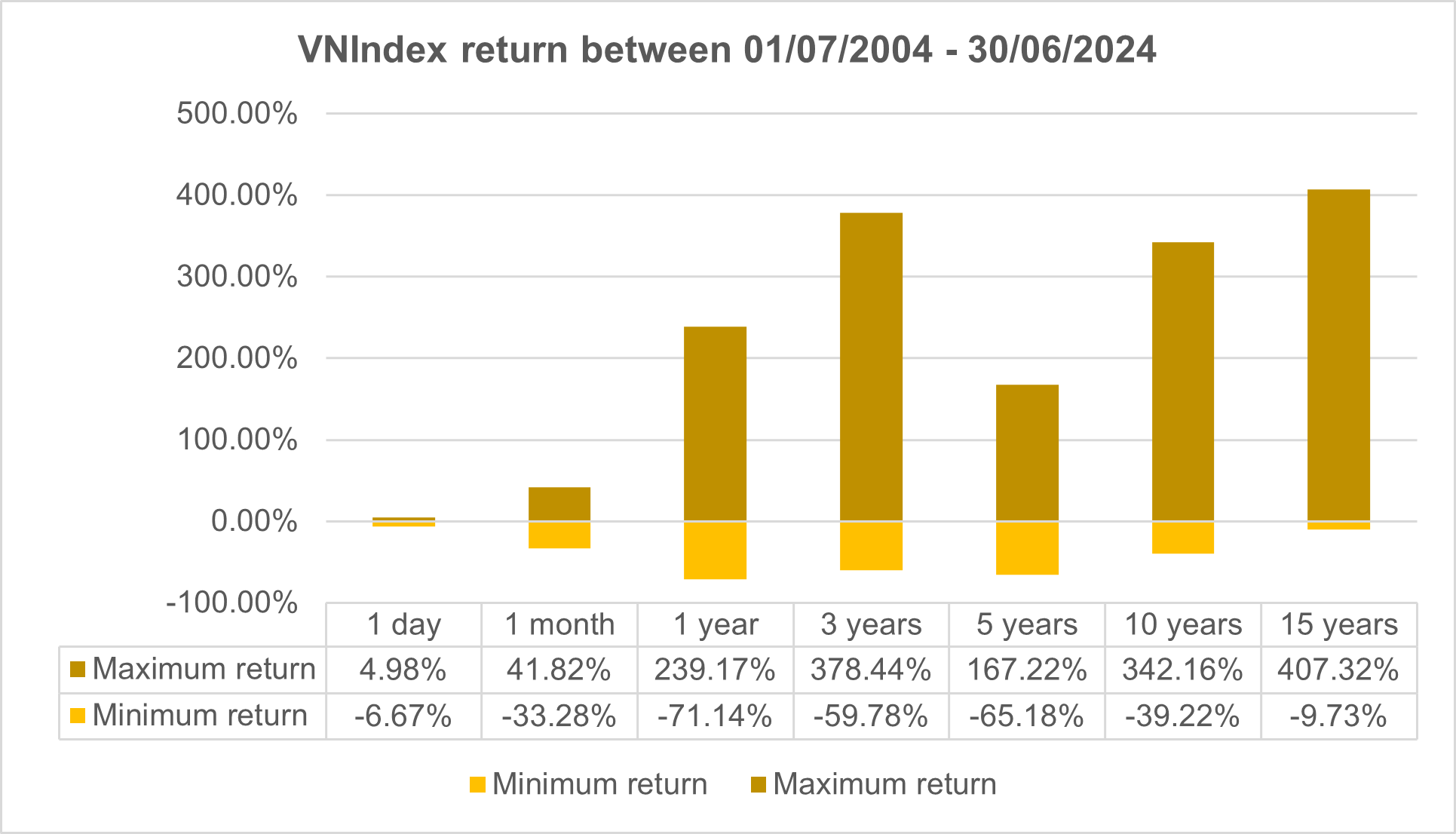

Figure 01 below shows the short-term (less than 1 year), medium-term (3-5 years) and long-term (10-15 years) VNIndex returns. It can be seen that if you invest in VNIndex within 1 month over past 20 years, the highest profit was 41.82% and the highest loss is -33.28%. The range between the maximum and minimum returns increased for 1-year investment, with 239.17% for the former and -71.14% for the latter. However, if the investor held index for the long run, 15 years, he could gain 407% profit compared to -9.73% loss.

Over the past 20 years, the data have shown that the Vietnamese stock market is not suitable for investments of less than one year. Moreover, the longer the investment period, the higher the expected returns compared to the anticipated losses.

Figure 01: VNIndex return between 01/07/2004 – 30/06/2024

(Source: PHFM)

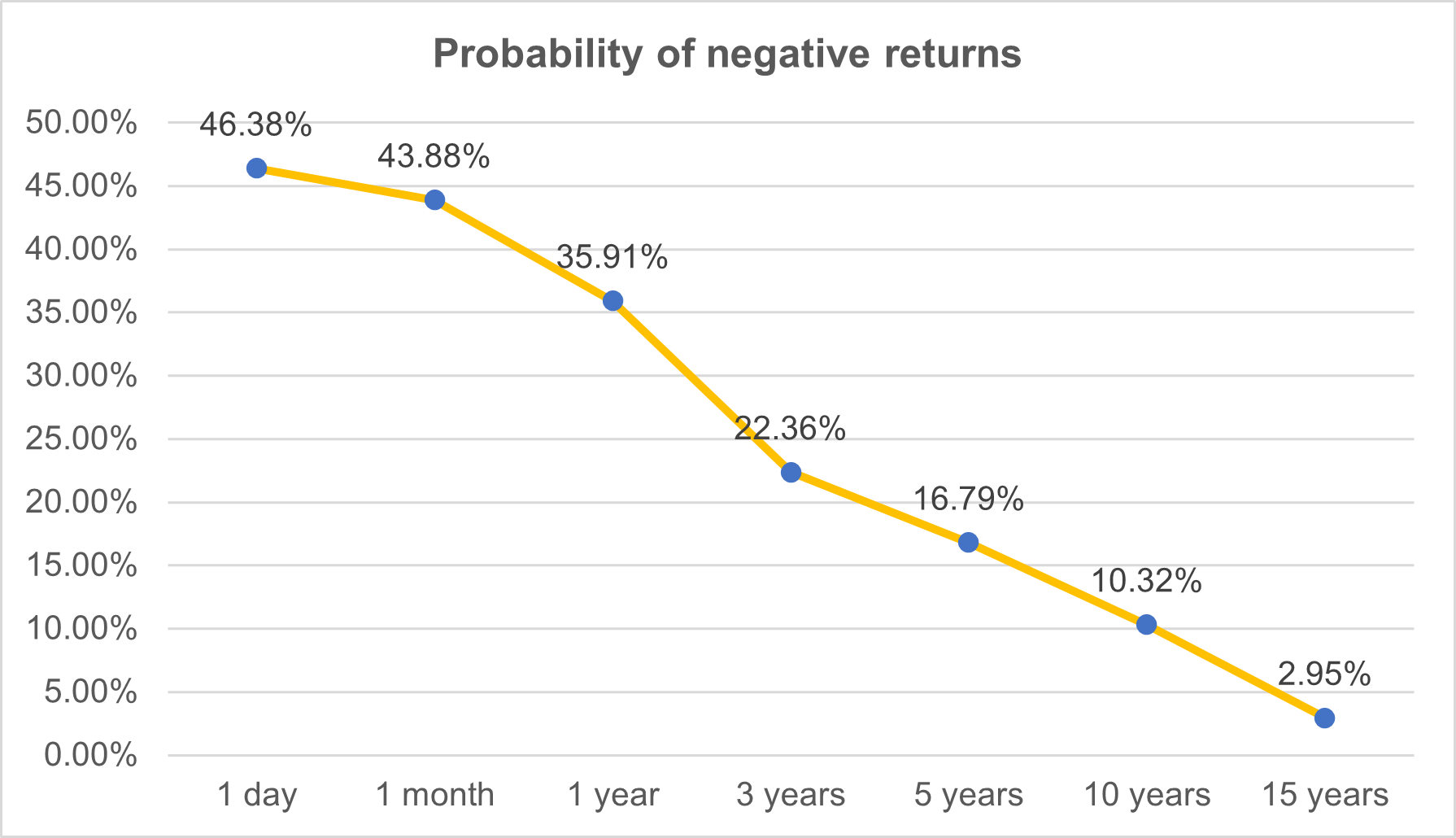

In fact, the probability of experiencing negative returns is higher for the short-term investing. The specifics indicators can be seen in the Figure 02 below. For under 1 year horizon, this number ranges from 35.9% to 46%. Meanwhile, the probability of loss for 3-year and 5-year horizon is 22.35% and 16.79%, respectively. This figure reaches 10.3% for a 10-year period and only 2.95% for a 15-year period. In other words, the longer the investment horizon, the greater the chance to make profit in the Vietnamese securities market. However, it is worth mentioning that this rule only applies to a diversified portfolio which includes many stocks from different industries, that helps reduce the negative effect of bad stocks picking.

Figure 02: Probability of negative returns of VNIndex during 20 years

(Source: PHFM)

Therefore, in our opinion, a long-term diversified portfolio investment strategy is the most suitable strategy for investors in the Vietnamese stock market. In fact, more and more busy investors are gradually turning to reputable open-end funds, which not only meet the ‘don’t put all your eggs in one basket’ strategy but also achieve expected returns that outperform the index. However, investors also need to persist in long-term investments with the systematic investment plan (SIP) products provided by the funds to achieve the highest asset growth goals and lower risk in the future.

Benefits of the systematic investment plan (SIP)

- It requires less time and effort to manage

- It is affordable for most people

- Investors do not have to worry too much about market fluctuations when entering the market.

- It offers reasonable returns over the long term by averaging investment costs.

Source: PHFM